Income Tax Rates By State Map

Income Tax Rates By State Map – Taxes may seem confusing, but they don’t have to be. We’re almost in the monthslong period when the Internal Revenue Service is accepting tax returns, and it’s essential to understand . There are nine California tax rates, ranging from 1% to 12.3%. Tax brackets depend on income, tax filing status, and state residency. California also levies a 1% mental health services tax on .

Income Tax Rates By State Map

Source : taxfoundation.org

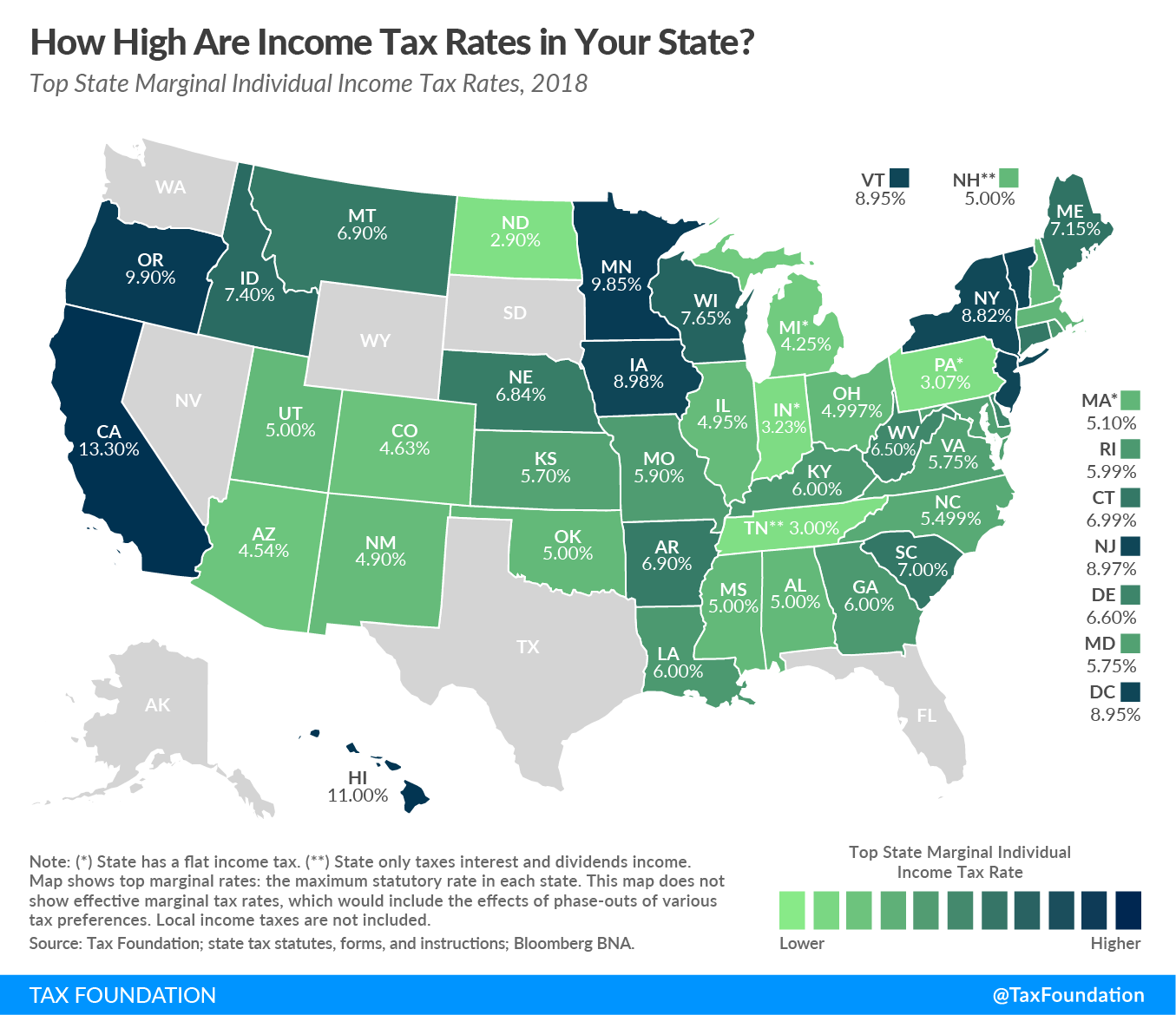

State Individual Income Tax Rates and Brackets for 2018

Source : taxfoundation.org

State Income Tax Rates and Brackets, 2021 | Tax Foundation

Source : taxfoundation.org

State income tax Wikipedia

Source : en.wikipedia.org

2023 State Income Tax Rates and Brackets | Tax Foundation

Source : taxfoundation.org

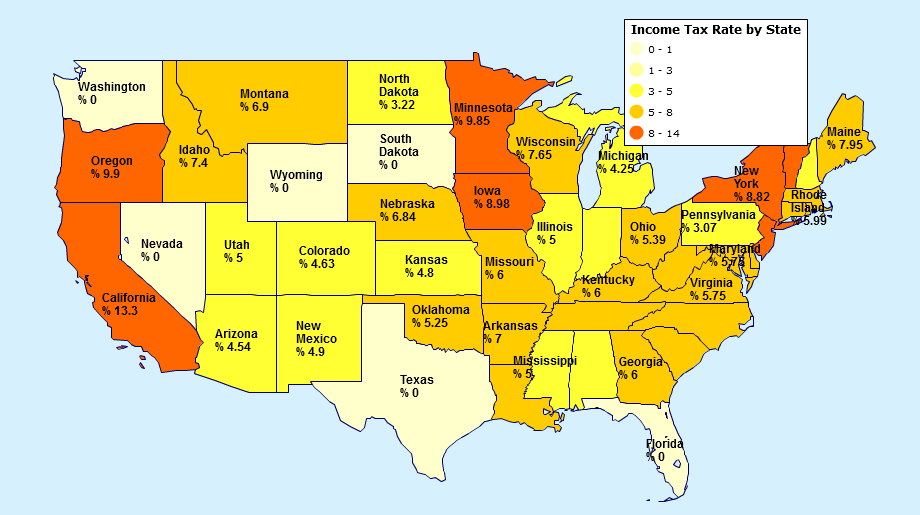

Top State Income Tax Rate Map | MapBusinessOnline

Source : www.mapbusinessonline.com

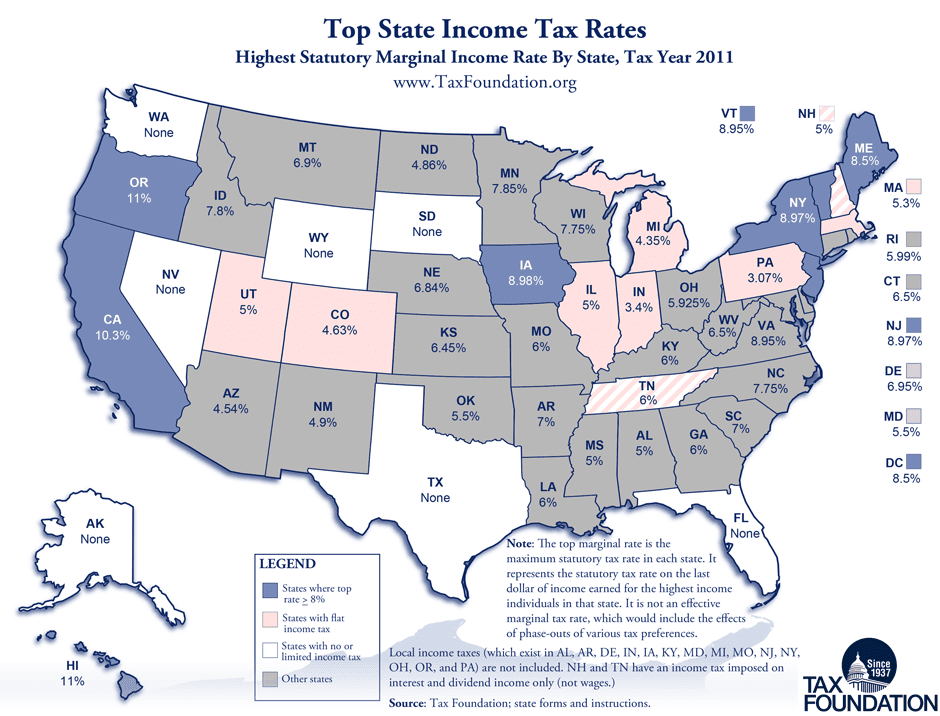

Monday Map: Top State Income Tax Rates, 2013

Source : taxfoundation.org

CARPE DIEM: Monday Map: State Income Tax Rates

Source : mjperry.blogspot.com

Monday Map: Top State Marginal Income Tax Rates, as of January 1st

Source : taxfoundation.org

State income tax Wikipedia

Source : en.wikipedia.org

Income Tax Rates By State Map Monday Map: Top State Income Tax Rates: New York has nine income tax rates: 4%, 4.5%, 5.25%, 5.5%, 6%, 6.85%, 9.65%, 10.3% and 10.9%. State income tax returns for 2023 are due April 15, 2024. The deadline for filing a return with an . Florida does not have a state income tax, while California does. However, both states have property and sales taxes. While such taxes generally have a flat rate and can appear to affect all taxpayers .